by Marcel Bila

Share

Marcel Bila

Share

Introduction

Digital transformation rapidly changes the business world, and the finance sector is not immune to this evolution. The emergence of new technologies and data-driven insights has revolutionized traditional finance processes, making them more efficient, accurate, and cost-effective. However, these changes also introduce new challenges, such as managing complex data sources and ensuring data accuracy and security. This is where Data Intelligence and tools like Corporate Performance Management (CPM) come in.

In this article, we will explore the role of Data Intelligence in digital transformation for finance processes, discussing its importance, benefits, challenges, and best practices. We will also look at the tools and technologies used for Data Intelligence, such as CPM, and case studies of successful implementation and the future of Data Intelligence in finance processes.

Understanding Data Intelligence and Its Importance in Finance

Data Intelligence involves collecting, analyzing, and interpreting data to provide meaningful insights and drive decision-making. It employs advanced analytics and artificial intelligence to understand complex data sets, identify patterns and trends, and predict future behavior. In finance, Data Intelligence is crucial for managing large amounts of financial data, improving financial reporting and analysis, and providing accurate forecasts and projections.

The importance of Data Intelligence in finance cannot be overstated. With the rise of digital transformation, finance teams face unprecedented data from multiple sources, such as transactional data, customer data, market data, and more. This data can be overwhelming and difficult to manage without the proper tools and expertise. Data Intelligence provides the necessary insights and intelligence to help finance teams make informed decisions, improve financial performance, and drive growth.

The Importance of Data Intelligence

In today’s fast-paced business environment, companies that are able to leverage Data Intelligence are better positioned to succeed. Here are some of the key reasons why Data Intelligence is important:

- Better Decision-Making: By leveraging Data Intelligence, businesses can gain a better understanding of their customers, identify new business opportunities, and optimize their decision-making processes. With the right data, decision-makers can make informed choices that are based on facts rather than intuition.

- Improved Operations: Data Intelligence can help businesses optimize their operations by identifying inefficiencies and bottlenecks. By analyzing data from various sources, businesses can identify areas where improvements can be made, such as reducing waste, improving supply chain efficiency, and streamlining production processes.

- Competitive Advantage: Companies that are able to leverage Data Intelligence are better positioned to gain a competitive advantage. By analyzing market trends and consumer behavior, businesses can identify new opportunities and develop innovative products and services that meet the changing needs of customers.

- Cost Savings: Data Intelligence can help businesses identify areas where cost savings can be realized. By analyzing data on expenses, businesses can identify areas where they can cut costs, such as reducing waste, optimizing resource allocation, and improving efficiency.

The Role of Data Intelligence and CPM in Digital Transformation for Finance Processes

Digital transformation aims to use technology to improve business processes, and finance is no exception. The goal of digital transformation in finance is to streamline processes, reduce costs, and improve accuracy and efficiency. Data Intelligence and CPM tools play a critical role in this transformation by providing the insights and intelligence needed to make informed decisions and optimize financial performance.

One of the key benefits of Data Intelligence and CPM in digital transformation for finance is the ability to automate manual processes. For example, Data Intelligence can automate financial reporting, eliminating the need for manual data entry and reducing errors. CPM tools can further enhance this automation by offering advanced planning, budgeting, and forecasting capabilities, allowing finance teams to accurately predict future performance based on historical data and other factors.

Another benefit of Data Intelligence and CPM in digital transformation for finance is improving risk management. By analyzing large amounts of financial data, Data Intelligence can identify potential risks and provide insights into how to mitigate them. CPM tools can help finance teams create scenario analyses and stress tests to understand the potential impact of these risks better, enabling them to make more informed decisions about investments and other financial decisions, reduce risk, and improve financial performance.

Data Intelligence and CPM provide numerous benefits for finance processes in digital transformation

- Improved Accuracy: Data Intelligence and CPM tools provide the insights and intelligence needed to make informed decisions, reducing errors and improving accuracy.

- Increased Efficiency: By automating manual processes and streamlining workflows, Data Intelligence and CPM can help finance teams work more efficiently and effectively.

- Better Risk Management: Data Intelligence and CPM can identify potential risks and provide insights into how to mitigate them, improving risk management and reducing financial losses.

- Cost Savings: By reducing errors and improving efficiency, Data Intelligence and CPM can help finance teams save money on operational costs.

- Improved Financial Performance: With the insights and intelligence provided by Data Intelligence and CPM, finance teams can make more informed decisions, leading to improved financial performance and growth.

- Enhanced Collaboration: CPM tools facilitate better collaboration between finance teams and other departments, ensuring that financial data is consistently and accurately integrated throughout the organization.

- Greater Agility and Responsiveness: Data Intelligence and CPM enable finance teams to rapidly respond to changing market conditions and make data-driven decisions in real-time, fostering greater agility and responsiveness.

Key Challenges of Implementing Data Intelligence and CPM in Finance Processes

While Data Intelligence and CPM offer numerous benefits for finance processes in digital transformation, there are also several key challenges to implementation. These challenges include:

- Data Quality: Data Intelligence and CPM require accurate and reliable data, which can be difficult to obtain with multiple data sources and complex data sets.

- Data Security: With the rise of cyber threats and data breaches, ensuring financial data security is critical but challenging.

- Technical Expertise: Implementing Data Intelligence and CPM requires specialized technical expertise, which may be difficult to obtain or costly to hire.

- Change Management: Implementing Data Intelligence and CPM requires significant changes to existing processes and workflows, which can be difficult to manage and implement.

Overcoming these challenges requires a strategic approach with the right tools, technology, and expertise.

Best Practices for Implementing Data Intelligence and CPM in Finance Processes

To successfully implement Data Intelligence and CPM in finance processes, there are several best practices to follow:

- Start with a Clear Strategy: Define your goals and objectives for Data Intelligence and CPM, and create a roadmap for implementation.

- Invest in the Right Tools and Technology: Choose the right Data Intelligence tools and CPM technology to fit your needs, budget, and resources.

- Focus on Data Quality and Security: Ensure your data is accurate, reliable, and secure by implementing data quality and security measures.

- Build the Right Team: Hire or train the right people with the technical expertise to implement and manage Data Intelligence and CPM.

- Prioritize Change Management: Communicate clearly and frequently with stakeholders and employees, and provide the necessary training and support to manage the changes.

By following these best practices, finance teams can successfully implement Data Intelligence and CPM, reaping the benefits of digital transformation.

Tools and Technologies for Data Intelligence and CPM in Finance Processes

Numerous tools and technologies are available for Data Intelligence and CPM in finance processes. These include:

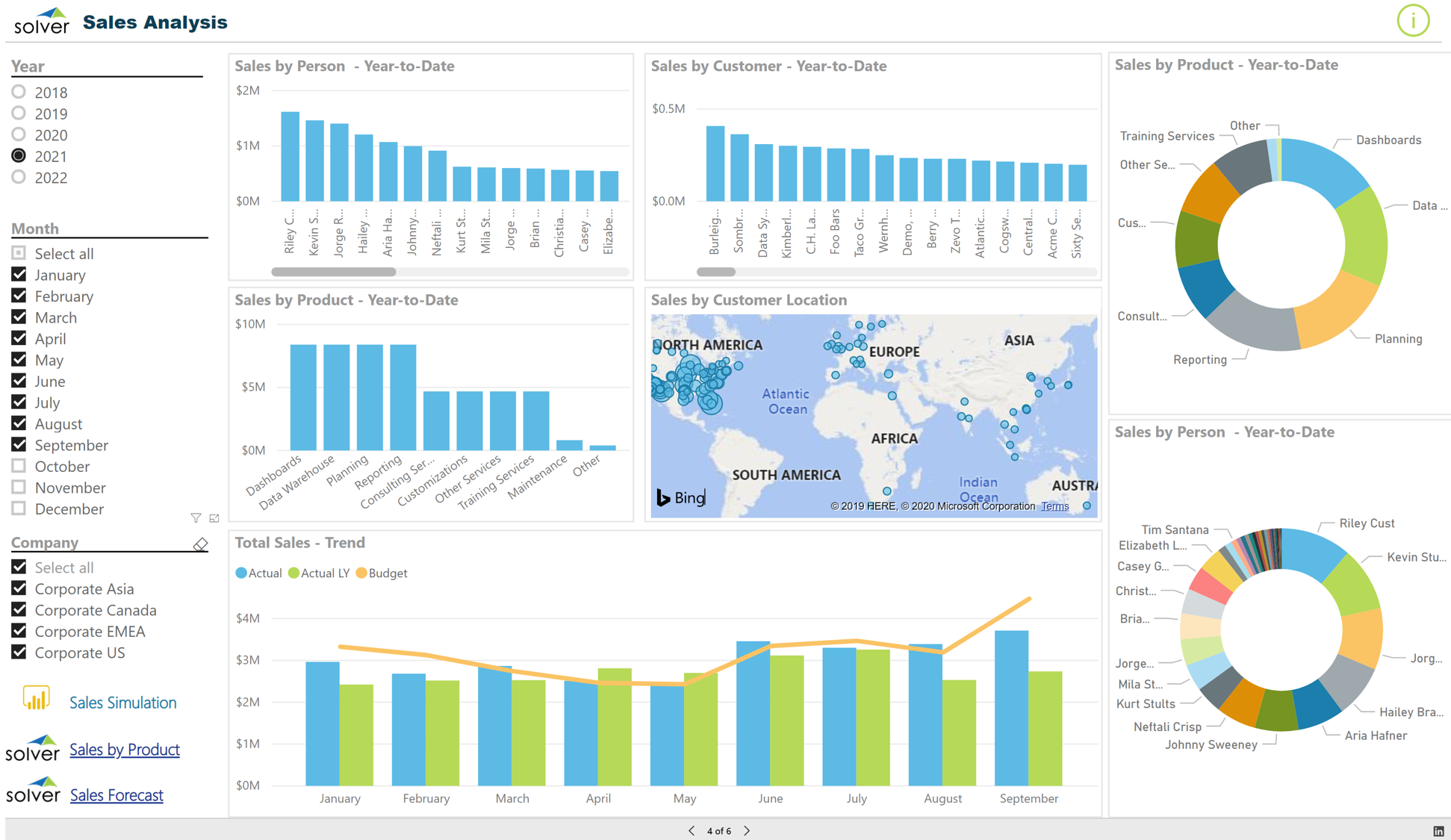

- Business Intelligence (BI) Tools: BI tools provide dashboards, reports, and visualizations to help finance teams analyze and interpret data.

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML can analyze large amounts of financial data and provide insights into trends and patterns.

- Robotic Process Automation (RPA): RPA can automate manual processes like financial reporting and analysis.

- Cloud Computing: Cloud computing provides secure and scalable storage and processing of financial data.

- Blockchain: Blockchain can securely and transparently store financial data, reducing the risk of fraud and errors.

- Corporate Performance Management (CPM) Software: CPM tools help finance teams with planning, budgeting, forecasting, reporting, and performance analysis, streamlining finance processes and improving accuracy.

By leveraging these tools and technologies, finance teams can take full advantage of Data Intelligence and digital transformation.

Case Studies of Successful Data Intelligence and CPM Implementation in Finance Processes

Numerous examples of successful Data Intelligence and CPM implementation in finance processes exist. One example is American Express, which used Data Intelligence to optimize foreign exchange trading. By analyzing large amounts of financial data, American Express was able to identify trends and predict market movements, leading to more accurate and profitable trades.

Another example is HSBC, which used Data Intelligence and CPM to improve its risk management processes. By analyzing financial data from multiple sources, HSBC was able to identify potential risks and take proactive measures to mitigate them, reducing financial losses and improving overall performance.

A third example is a global manufacturing company implementing a CPM solution to streamline its budgeting, forecasting, and reporting processes. This allowed the company to consolidate financial data from various sources, automate manual tasks, and provide real-time insights into performance. As a result, the company experienced a significant reduction in the time required for budgeting and forecasting, improved accuracy, and increased collaboration between departments.

These case studies demonstrate the power of Data Intelligence and CPM in finance processes and highlight the benefits of digital transformation.

Future of Data Intelligence and CPM in Finance Processes

As digital transformation continues to reshape finance processes, the future of Data Intelligence and CPM looks bright. With the rise of new technologies and data sources, finance teams must increasingly rely on Data Intelligence and CPM to make informed decisions and optimize financial performance. This will require ongoing investment in tools, technology, expertise, and a commitment to data quality and security.

Looking ahead, we can expect continued innovation in Data Intelligence and CPM, including AI, ML, and blockchain, to drive even greater insights and intelligence. Advanced analytics and predictive modeling capabilities will become even more sophisticated, enabling finance teams to make better decisions and drive business growth. Additionally, integrating CPM tools with other enterprise systems and applications will further streamline processes and improve data accuracy.

Finance teams that embrace Data Intelligence and CPM in their digital transformation journey will be well-positioned to succeed in the years to come.

Conclusion

In conclusion, Data Intelligence and CPM are the keys to successful finance processes in digital transformation. Data Intelligence and CPM can help finance teams improve accuracy, efficiency, and financial performance by providing the insights and intelligence needed to make informed decisions. However, implementing Data Intelligence and CPM requires a strategic approach with the right tools, technology, and expertise. By following best practices and leveraging the right tools and technologies, finance teams can successfully implement Data Intelligence and CPM, reaping the benefits of digital transformation. As the future of finance processes becomes more reliant on data-driven decision-making, organizations that invest in Data Intelligence and CPM will be well-equipped to navigate the challenges and opportunities of the evolving business landscape.